The #1 Solution

for Managing Cyber Risks across Portfolios

Our advanced Cyber Risk Quantification engine delivers clear, actionable insights into your clients’ and prospects’ risk exposure. Make confident, data-driven decisions with unparalleled speed, precision, and reliability.

What Citalid Portfolio does for you

Empowering Insurers to Grow Portfolios with Confidence

Portfolio De-Risking:

Citalid aligns your portfolio with your risk appetite by providing tailored security recommendations that enhance client risk profiles and inform insurance adjustment actions.

Loss Ratio Optimization:

Citalid delivers data-driven insights to optimize risk assessment and pricing, minimizing claims through proactive measures and aligning premiums more closely with customers’ actual risk exposure.

Streamlined Renewals and Client Acquisition:

By fostering transparency and confidence, Citalid Portfolio simplifies the renewal and acquisition process. Premium adjustments reflect evolving risks, ensuring fair and accurate pricing that strengthens client relationships.

Reinsurance Transfer Optimization:

Citalid Portfolio minimizes uncertainty for insurers, enabling better risk segmentation and strategic structuring of reinsurance coverage.

Empowering Brokers to Build Confidence and Strengthen Customer Relationships

Cyber Expertise:

Leverage Citalid’s AI and Cyber Threat Intelligence to showcase your innovative capabilities, enhancing your competitive edge in tenders and streamlining the underwriting process for smaller risks.

Comprehensive Risk Management Guidance:

Offer holistic advice on every aspect of risk management—from identification and mitigation to risk sharing. By supporting your clients throughout the entire process, you build trust and foster lasting relationships.

Tailored Customer Solutions:

Deliver tailored insurance solutions that empower your clients to make informed decisions about their risks, instilling a high level of confidence in their choices.

Easier Renewals:

Proactively manage renewals with dynamic assessments of your clients’ risk profiles, informed by their security investments and the ever-changing threat landscape.

Empowering Financial Institutions to Safeguard Profitability with Data-Driven Strategies

Improved Resilience:

Strengthen the accuracy and depth of credit risk evaluations by incorporating cyber risk exposure as a critical metric. Better predict corporate clients’ financial health and resilience against cyber threats, reducing default risk.

Revenue Diversification:

Offer a comprehensive suite of services that address the key factors influencing your clients’ risk profiles. Unlock new revenue streams, diversify your services, and build stronger, more enduring client relationships.

Empowering Enterprises to Strengthen Compliance and Third-Party Risk Management

Proactive Risk Identification:

Identify high-risk third-party providers early to make informed decisions, enforce critical security requirements, and safeguard your operational integrity against potential vulnerabilities.

Enhanced Supply Chain Compliance:

Strengthen your supply chain’s cyber resilience by assessing partners’ cyber risks and guiding them toward meeting your security expectations, ensuring alignment with compliance standards.

Optimized Resource Allocation:

Prioritize security efforts where they matter most by focusing on high-risk partners. This targeted approach maximizes resource efficiency while reinforcing the overall resilience of your partner network.

Empowering MSSPs to Deliver Unmatched Value as Trusted Cybersecurity Advisors

Customized Risk-Based Services:

Align your services with clients’ real risk profiles through a personalized, value-driven approach to cyber risk management. Offer solutions that prioritize and maximize the effectiveness of their cybersecurity investments.

Cyber Roadmap:

Efficiently assess the cyber risk of your clients and prospects to facilitate their decision-making process and prioritize their needs.

Increased Value:

Monitor your client risk proactively, keep your client informed and demonstrate value by reducing risk exposure and increase return on security investment over time.

See Citalid Portfolio in action

Start quantifying your clients & prospects cyber risk, now.

A Unified Platform for Questionnaires, Scans, Risk Analysis, Policy Modeling, and Reporting

The Citalid Portfolio enables seamless monitoring and quantification of both individual and aggregated cyber risks across your entire portfolio. Built for precision and efficiency, it supports data-driven decision-making by delivering clear, actionable reports that are fast to generate and easy to understand. Gain a strategic edge with instant insights that empower you to proactively safeguard your portfolio’s value and ensure its long-term resilience.

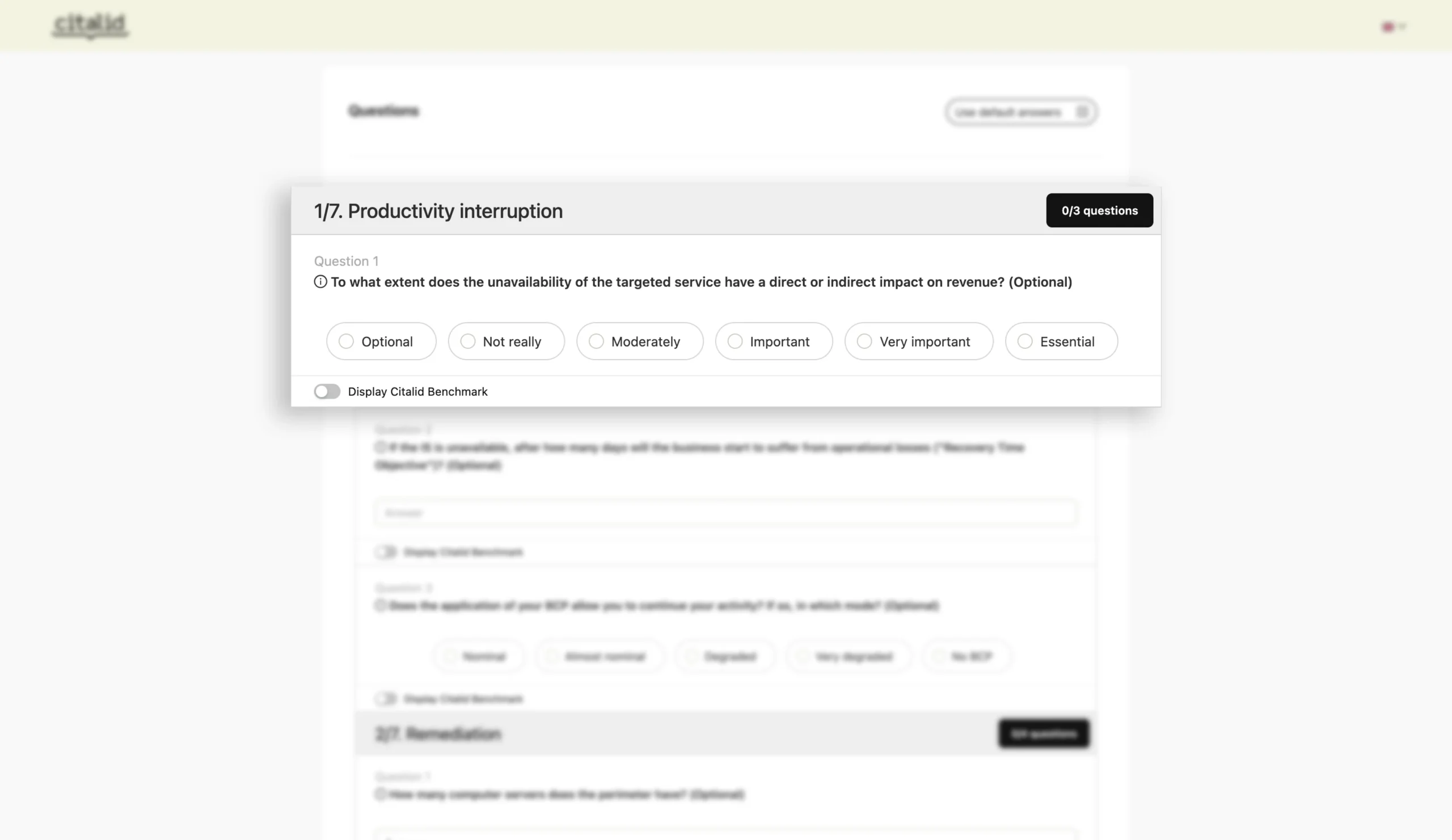

Questionnaire & Security Management

Provide bespoke security recommendations to strengthen trust and build long-lasting client relationships

- Use your own security questionnaire or Citalid’s pre-built one

- Manage, store, and access all your security questionnaires in one unified platform

- Help your clients and prospects reduce their risk exposure with actionable recommendations

- Empower your clients and prospects to proactively reduce their risk exposure

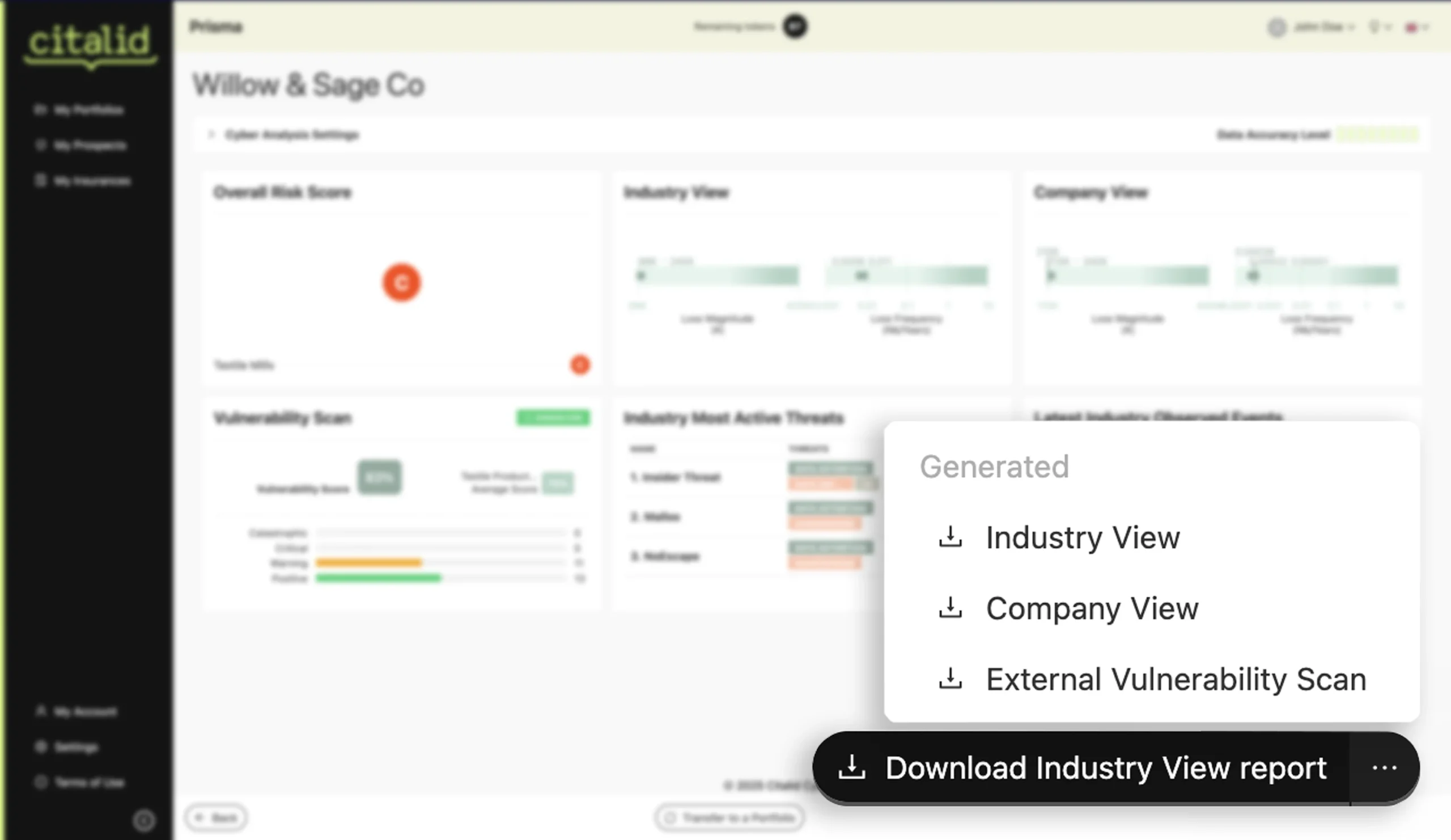

Report Management

Get hands-on materials that you can act-on to boost your business partners relationship:

- Generate comprehensive, easy-to-interpret reports instantly

- Keep a detailed history of reports for each client

- Deliver in-depth, comprehensive reports on your clients’ risk profiles

- Leverage complimentary reports and analyses aligned with your sales process

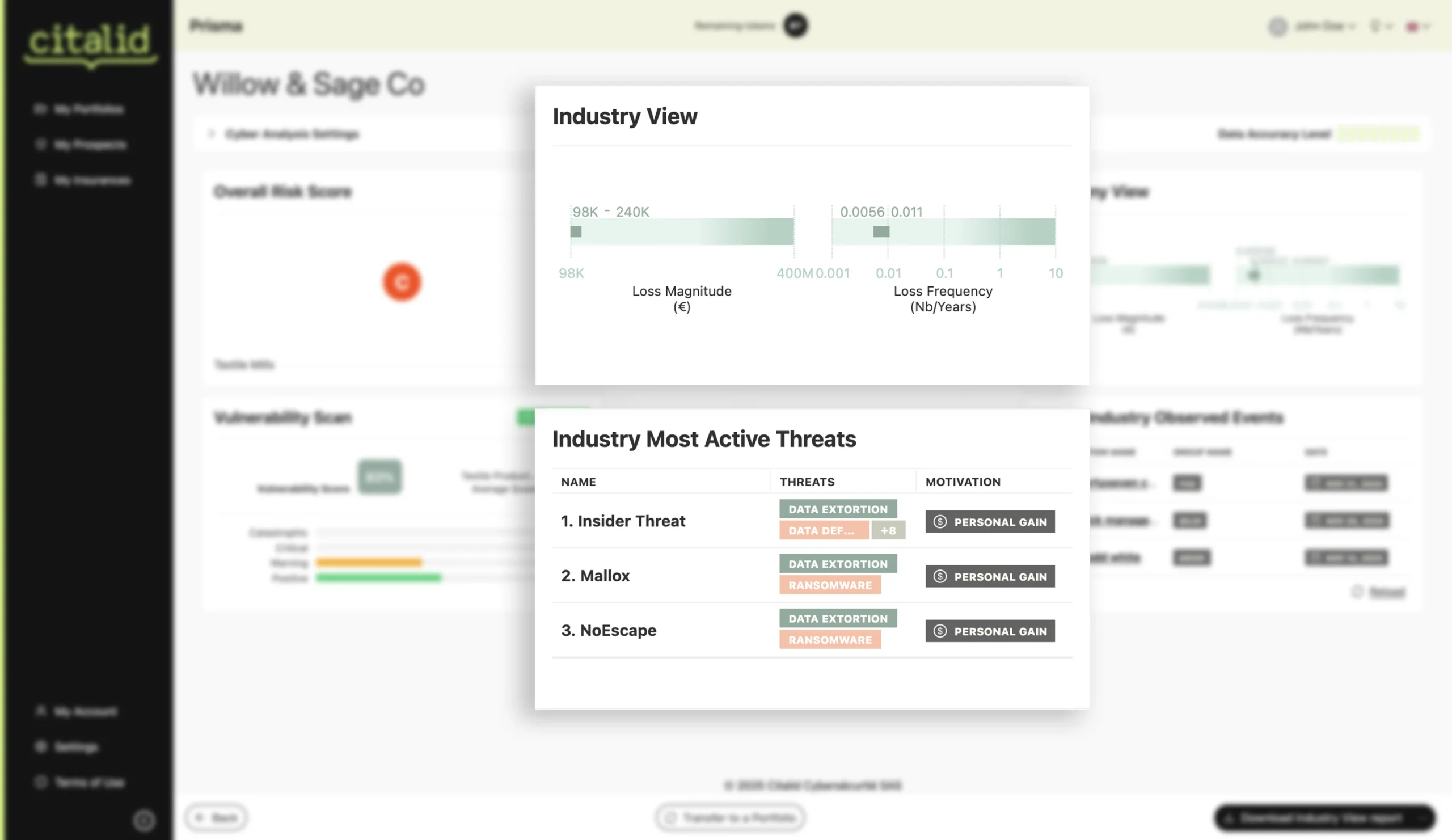

Industry Risk Analysis

Quickly assess a prospect’s risk profile vs. industry peers

- Understand how often incidents occur within the industry

- Gauge the potential financial impact of cyber incidents

- Leverage Citalid’s industry risk score and benchmarks

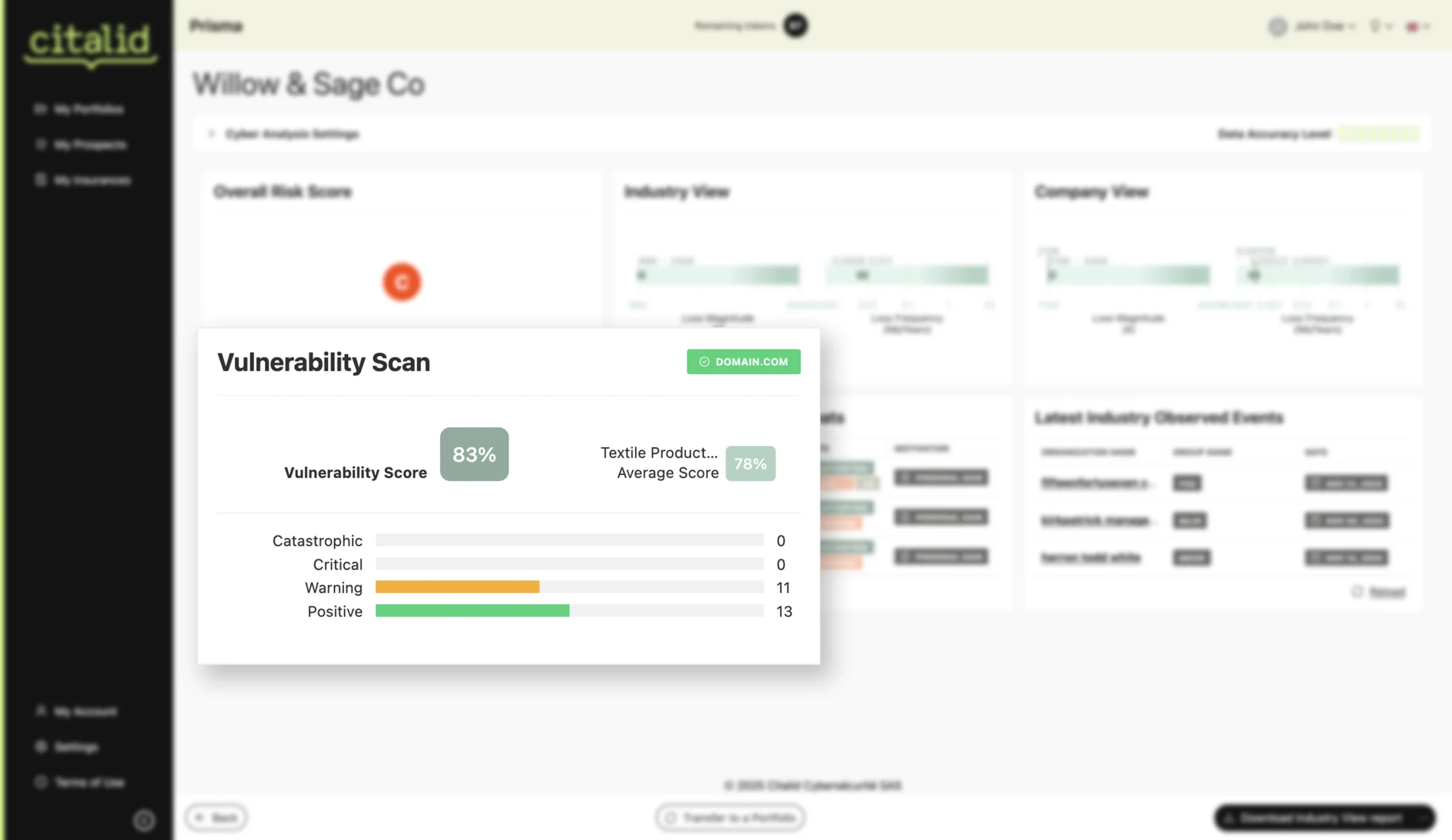

External vulnerability scan

Identify Exposure Signals

- External attack surface assessment of the company including:

- Benchmark against representative peers in the same industry

- Tailor-made vulnerability detection and security recommendation

Company risk analysis

Deep-dive into each portfolio line to facilitate meaningful discussions with mature clients

Comprehensive cyber risk assessment including:

- Online cyber maturity questionnaire to share with clients

- Detailed claim frequency and severity assessments

- Likely financial losses broken down by category, such as business interruption, remediation and legal costs

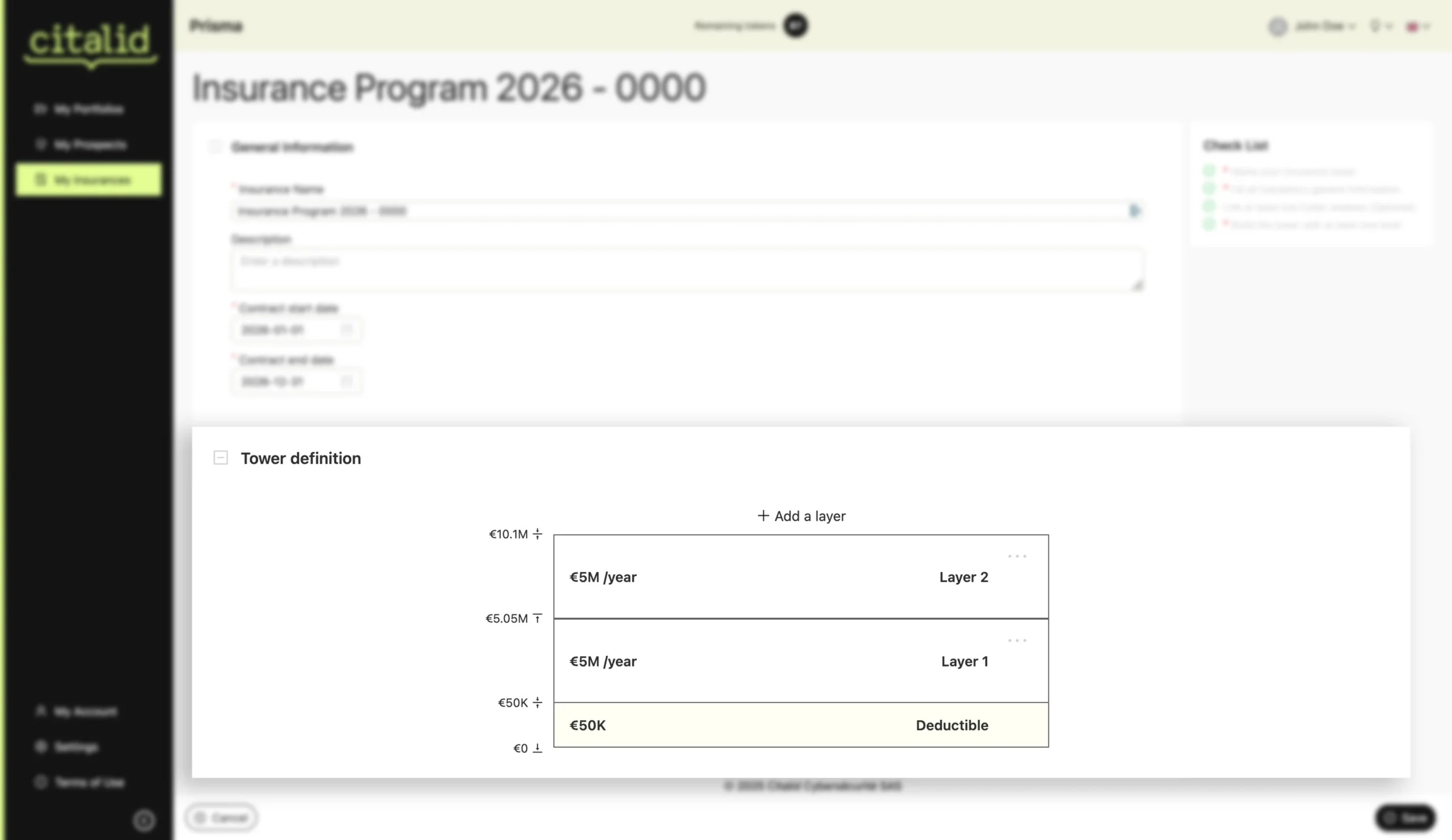

Insurance Policy Modeling

For Ransomware & Data disclosure scenarios :

- Design customized insurance policies aligned with your clients’ unique risk exposures

- Improve the value proposition of your insurance offerings while maintaining sustainable loss ratios

Citalid Portfolio in numbers

Risk Quantifications

Minutes per Risk Quantification

Full transparency regarding CRQ

AI-Driven Cyber Risk Modeling with Proven Reliability

Our AI-driven models are calibrated and back-tested using real-world data enriched by strategic threat intelligence and insurance partnerships. This ensures a best-in-class solution, eliminating any black-box effect.